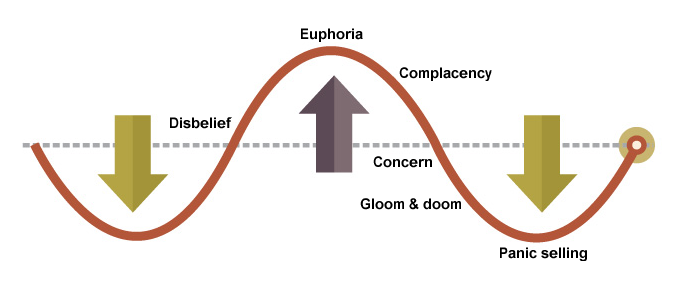

There are bull markets, bear markets, and then there are the volatile markets; all of which have the ability to create an emotional roller-coaster for investors as they react to economic and political events. Below, is a representation of the typical rollercoaster ride:

Riding out market volatility is a stomach-churning experience that can undermine the confidence of even the most stalwart investors. Without discipline, it is easy for a rational investor to make irrational market reactions as they become influenced by their emotions. Learning how to weather the market storms is essential for long term success. With that in mind, here are a few things to remember in times of uncertainty and volatility:

Have a Plan and Stick to It

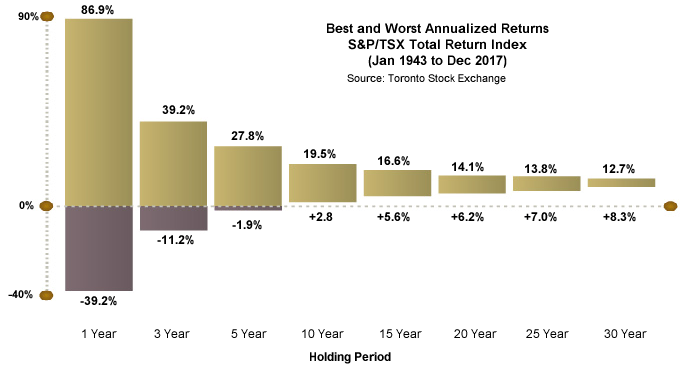

The most successful investors may follow the day-to-day drama of the markets, but they stick to the strategy they devised in calmer times. Patience, not panic, determine the long-term success of their investments. The chart below takes a look at stock market returns from 1943 to 2017 and shows the best and worst annualized returns over various holding periods.

As your time horizon and holding period increases, the risk of losing money in the stock market drastically decreases. It’s important to remember a well-thought-out, broadly diversified portfolio is essential for risk management. Sticking with that diversified plan even during periods of volatility is what defines investor success over the long-run.

For more info on the planning process, check out our article on Financial Planning.

Stay with Quality

Long-term investors who have been through sell-offs in previous years know that time is on their side if they own good quality investments.

High quality, blue-chip investments with a proven track record of earnings performance or dividend payout may be dragged down with the turbulence, but will typically have less dramatic price fluctuations. As long as the business outlook for the company has not changed, it is likely that its share price will be restored when the market recovers.

Listen for the Knock of Opportunity

Market volatility can present buying opportunities for long-term investors who have cash in their portfolios. You may consider investing more in the most viable long-term investments in your portfolio or have a shortlist of other quality buy candidates that become available at discounted prices.

This may also be a time to strategically upgrade your portfolio—selling poor performers and replacing them with stronger (yet also devalued) assets. However, do so only if the buy candidates fit into your overall investment goals and objectives.

Remember the Big Picture

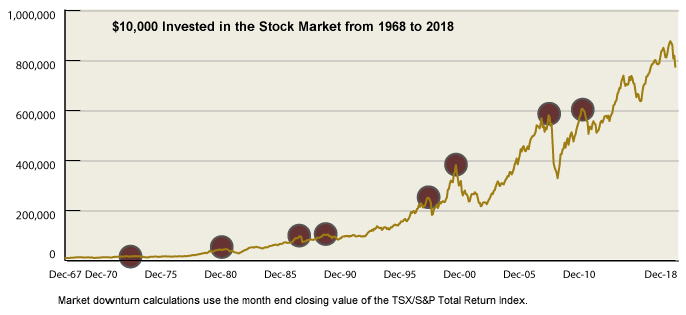

Dramatic markets make good headlines, but they need perspective.

Volatility is typically a short-term phenomenon measured in days, weeks, and

months. But over the years, the historic performance of the stock market is a

patient reflection of the growth in the economy and the businesses that

contribute to that growth. Long-term investors can take comfort in the steady

increase in value that major stock markets have demonstrated over the years.

Drown Out the Background Noise

The media coverage of volatile markets can range from

rational and insightful analysis to sound bites characterized by

end-of-the-world rhetoric. Don’t make investment decisions contrary to your

risk appetite; filter out the background noise and resist falling prey to the

herd mentality during turbulent markets.

Think Strategically

Talk to your financial advisor to ensure your investment strategy is structured to ride through volatile and uncertain investment periods. Especially during times of volatility, it’s best to consult a professional before making changes in terms of asset allocation, investment diversity, or risk tolerance.

There is no such thing as a risk-free investment portfolio in uncertain times, but there are ways to give you peace of mind and help you sleep well at night