Inflation is a key investment concept that comes up over and over again in our interactions with clients. Regardless of whether interest rates are high or low, having a solid understanding on the impacts of inflation is extremely important.

What is Inflation?

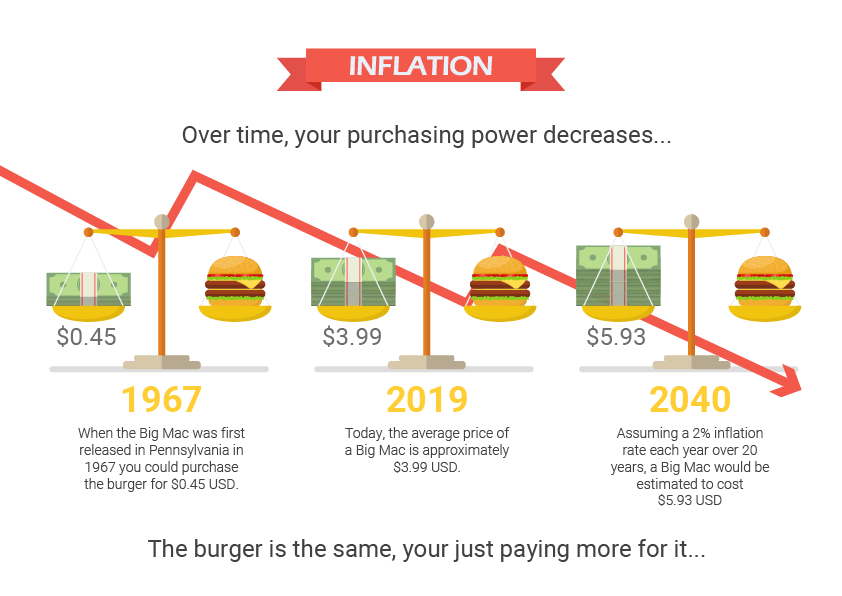

Put simply, inflation is the increase in prices of goods and services over time. In other words, the amount of money you have today will buy you less in the future. The graphic below illustrates the concept by looking at the price of a big mac over time.

2040 price estimate based on future value of $3.99 compounded at 2% annually for 20 years.

Economists look at a wide range of goods and services which, when aggregated, is referred to as a basket of goods. The cumulative price changes of the basket is measured year over year by the Consumer Price Index (CPI). When the CPI shows signs of high inflation, central banks are triggered to hike rates in an attempt to dampen an overheating economy. Consequently, this forces banks and other lending institutions to also raise interest rates on mortgages and household debt.

Canada’s core inflation rate is about 2% – a reasonably good figure by world standards, but a misleading one. While it may be a helpful figure for economists plotting monetary policies, for individual investors, it doesn’t tell the whole story about their personal living costs.

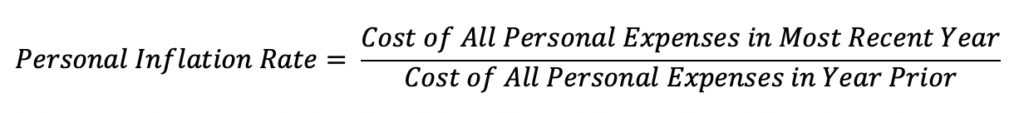

Investors should be paying more attention to their personal inflation rate, which takes the CPI economic concept and applies it to your personal expenses.

Calculating Your Personal Inflation Rate

Here is an example:

- 2019 expenses totaled $84,000

- 2018 expenses totaled $80,000

- Your personal inflation rate is $84,000/$80,000 = 1.04 (or 4%)

Having a ballpark total is useful; however, diving into the individual spending areas really gives you an idea of where those price changes are coming from. Try to work out your own personal inflation rate. Itemize the top fixed and variable household expenditures and compare what you’re paying now to last year. Listed below are some of the overarching categories and what to expect:

0% inflation is expected in many key areas:

- Mortgages

- Life insurance

- Auto loans/leases

When you look at areas that represent your consumption, things start to get interesting:

- Dining out expenses

- Utilities (natural gas, electricity, water)

- Car fuel

- Groceries

- Entertainment

- Travel

- Other miscellaneous

Pay attention to recurring expense categories because they can sneak up on you too:

- Cable/internet

- Mobile phone plan

- Home insurance

- Auto insurance

I personally do this exercise annually because it helps me keep track of consumption habits and alerts me to lifestyle adjustments that might become necessary in the future.

Having an understanding of your personal inflation rate is a natural segue into having a better understanding of personal debt. Did you know the average Canadian has a 177.1% debt-to-income ratio and spends $1.77 on average for every $1.00 earned?

Get a Handle on Debt

Work out a plan to review all household debt, paying attention to the interest rates on your mortgage, lines of credit, and credit cards. Now is the time to begin looking for ways to bring those figures down. The less debt you have and the closer to the prime rate you borrow money at, the better off you are.

Talk with your bank about the possibility of renegotiating a specific loan rate or the advisability of switching from a variable to a fixed-rate mortgage. Some financial institutions now offer umbrella or all-in-one banking services that can consolidate banking functions so that debt payments and chequing accounts and savings accounts operate in unison and reduce monthly interest costs.

Inflation-Proof Investments

There is no such thing as an inflation-proof investment, but investors can take measures to protect themselves. Risk-averse investors, particularly those nearing and in retirement, will need to be especially careful of what inflation can do to them if their investments can’t keep pace with inflation. Investors using bond ladders will want to stagger the maturity dates at shorter intervals. For equity investors, companies that are able to pass on their cost increases to customers and corporations that have low debt offer some safety in an inflationary environment. Precious metals can also be a good hedge for investors in inflationary times.

If global or personal inflation is a concern, feel free to reach out. We are more than happy to discuss actionable steps that can be taken to protect and prepare your investment portfolio.