Key Things To Remember:

2) Do not try to predict market movements during the US election.

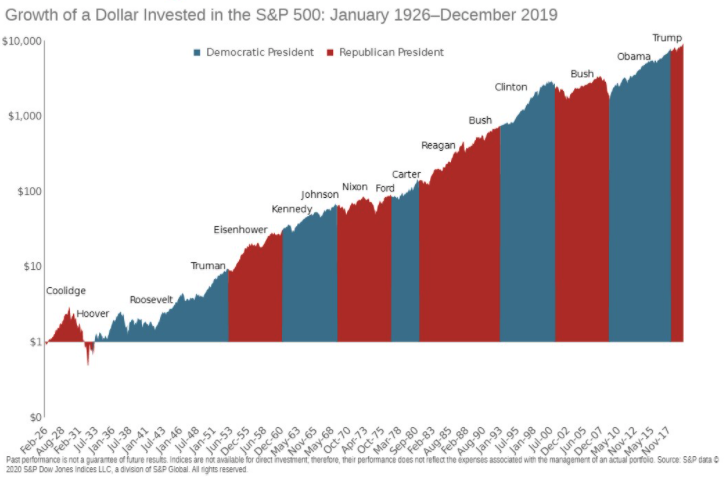

3) Remember that the stock market goes up on average over time, no matter which party is in power.

How Do Markets Perform During Election Years?

| Year | Return | Candidates |

| 1928 | 43.6% | Hoover vs. Smith |

| 1932 | -8.2% | Roosevelt vs. Hoover |

| 1936 | 33.9% | Roosevelt vs. Landon |

| 1940 | -9.8% | Roosevelt vs. Willkie |

| 1944 | 19.7% | Roosevelt vs. Dewey |

| 1948 | 5.5% | Truman vs. Dewey |

| 1952 | 18.4% | Eisenhower vs. Stevenson |

| 1956 | 6.6% | Eisenhower vs. Stevenson |

| 1960 | 0.50% | Kennedy vs. Nixon |

| 1964 | 16.5% | Johnson vs. Goldwater |

| 1968 | 11.1% | Nixon vs. Humphrey |

| 1972 | 19.0% | Nixon vs. McGovern |

| 1976 | 23.8% | Carter vs. Ford |

| 1980 | 32.4% | Reagan vs. Carter |

| 1984 | 6.3% | Reagan vs. Mondale |

| 1988 | 16.8% | Bush vs. Dukakis |

| 1992 | 7.6% | Clinton vs. Bush |

| 1996 | 23.0% | Clinton vs. Dole |

| 2000 | -9.1% | Bush vs. Gore |

| 2004 | 10.9% | Bush vs. Kerry |

| 2008 | -37.0% | Obama vs. McCain |

| 2012 | 16.0% | Obama vs. Romney |

| 2016 | 12.0% | Trump vs. Clinton |

Data Source: Morningstar

How Do Markets Perform Under Different Administrations?

How To Manage Your Investments During An Election Year

Should you make changes to your asset allocation during an election year or after a new president is elected? Probably not. Focusing on what you can control is key when investing for the long-term. Even if the market is caught off-guard by the election results (as evidenced in 2016 when President Trump won), the shock will likely be temporary. It can be hard, but it’s really important not to allow personal feelings about politics interfere with your financial plan.

The Information is being presented without consideration of the investment objectives, risk tolerance or financial circumstances of any specific investor and might not be suitable for all investors. Past performance is not indicative of future results.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.