The essence of lasting, successful equity investing is long-term compounding. It’s about faith, patience, and discipline and can be overwhelmingly temperamental. The key is to never interrupt the compounding and take advantage of prices when they are down.

The History of Bull and Bear Markets

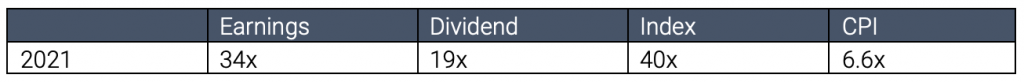

Over the last 50 years, the S&P has had some impressive growth. When we compare growth multiples to the Consumer Price Index (CPI) which measures inflation over the same time period, we can clearly see investing in equities more than makes up for the erosion of purchasing power caused by inflation.

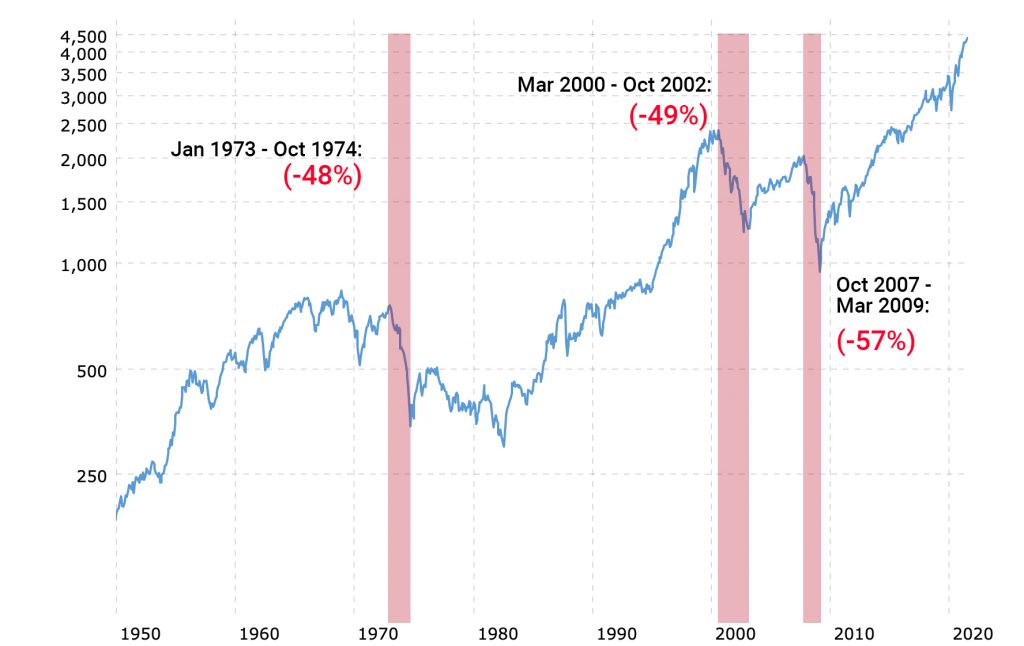

Inflation rose 6.6x over the last 50 years, while the broad S&P 500 index increased 40x. The long-term trend is undeniable. However, if you look at the chart below, it becomes evidently clear that the meteoric rise of the stock market wasn’t even close to a smooth ride to the top.

S&P 500 Historical Data 1950 – 2021

There are numerous times where the strong upward trend was interrupted and the market saw a temporary, but sharp decline. If you were able to maintain your long-term focus, you would have come out with almost 40x your initial investment over the last 50 years. If, on the other hand, you gave in to the lingering feelings of fear and panic, your retirement account today would be a mere shadow of its long-term potential.

When does an emotional mistake become a permanent loss?

The reality is that losing a dollar hurts twice as much as the joy you get from making a dollar. It’s because of these strong emotions that investors will commonly take themselves out of the market at precisely the wrong time. When the tide turns and the market starts to recover, these same investors often buy back into their positions at higher prices in a cycle we commonly refer to as “the round-trip”.

When you fall victim to the round-trip mentality, you end up missing out on months or years of cheap prices and inflict permanent damage on your retirement account. It’s okay to feel the fear, you wouldn’t be human if you didn’t… But it’s another thing to act on that fear. Always remember that the moment you sell, your decision becomes locked in and it’s at that moment your emotional mistake becomes a permanent loss.

Are there any strategies for profiting in Bull and Bear Markets?

There are three strategies that we would like to touch on in this post.

The first strategy often gets brought up on this blog – dollar-cost averaging. The baseline for this strategy is to choose a pre-determined amount you want to invest at a fixed interval, usually monthly. Under this strategy, you end up buying more shares when prices go down, and fewer shares when prices are more expensive. This is an incredible strategy for profiting in both bull and bear markets and should be a core strategy for all long-term investors.

The second strategy takes the idea of dollar-cost averaging one step further. In months where prices decline significantly, it is beneficial to increase your investment amount for that month. This ensures you are taking full advantage of black-Friday stock prices when they are on sale.

The final strategy is to reinvest dividends as soon as they are paid regardless of whether it is a bull or bear market. This is a passive strategy that will allow you to take full advantage of the benefits of compounding. The best part is, once you make the decision to reinvest dividends, these transactions happen in the background, and you hardly even notice them happening!

Summary

If there is one thing to take away, it should be the reminder to never stop the compounding. When you sell out of fear, your emotional mistake becomes a permanent loss, and that permanent loss can have a direct impact on your retirement. Instead, when prices go down, that’s your cue to buy more! Always remember to stay disciplined and stick with your long-term plan.

Thinking about hiring a professional to help you implement strategies like those mentioned in this article? We would be more than happy to set up a 30-minute discovery call to get a better understanding of your unique situation.

Read The Full Commentary

If you do not have access to our monthly email, you can request it here:

Your privacy is fully protected. By filling out this form to request this month’s commentary, you give explicit permission for LT Wealth Management Partners to email you to deliver our e-newsletter. It is important to note that your consent acknowledges agreeing to receive our newsletter knowing that your name and email may be stored on external servers outside of Canada.